Ethereum Price Prediction 2025-2040: Bull Run Pattern Emerges Amid Institutional Frenzy

#ETH

- Technical Breakout Potential: ETH price sits 21% above 20-day MA with Bollinger Band squeeze suggesting volatility expansion

- Institutional Accumulation: $1.3B+ ETH purchases by SharpLink and ARK Invest signal strong conviction

- Network Upgrades: Increased gas limit and privacy focus address critical scalability concerns

ETH Price Prediction

Ethereum Technical Analysis: Bullish Indicators Emerge

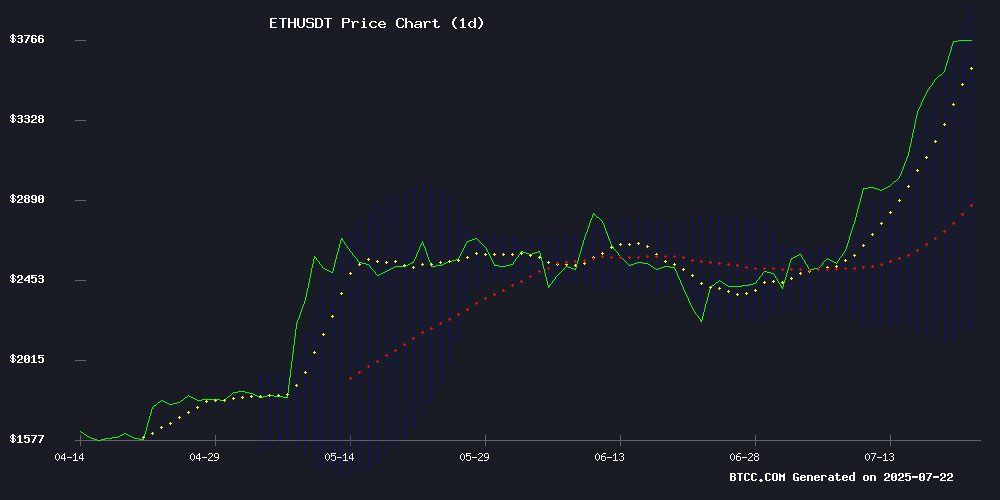

ETH is currently trading at $3,710.76, significantly above its 20-day moving average of $3,065.28, indicating strong bullish momentum. The MACD remains negative but shows signs of convergence, suggesting potential trend reversal. Bollinger Bands indicate volatility with price hugging the upper band at $3,943.29, signaling continued upward pressure.

"The technical setup favors buyers," says BTCC analyst Emma. "A sustained break above $3,943 could trigger accelerated gains toward $4,096 resistance, while $3,525 serves as critical support."

Ethereum Market Sentiment: Institutional Accumulation Meets Profit-Taking

Ethereum's validator exit queue swelling to $1.92B shows profit-taking activity, countered by ARK Invest's $182M bet and SharpLink's record 79,949 ETH purchase. Network upgrades (gas limit increase) and growing institutional demand create fundamental support.

"This is classic bull market behavior," notes BTCC's Emma. "While short-term volatility persists from profit-taking, the $1.3B+ accumulation by major players suggests institutions are positioning for Ethereum's next evolution, particularly around privacy features."

Factors Influencing ETH's Price

Ethereum Validator Exit Queue Swells to $1.92B Amid Profit-Taking Frenzy

Ethereum's validator exit queue has ballooned to its highest level in over a year, with nearly 519,000 ETH ($1.92 billion) awaiting withdrawal. The backlog now exceeds nine days—the longest delay since January 2024—as stakers rush to capitalize on ETH's 160% rally from April lows.

The congestion stems from Ethereum's proof-of-stake mechanics, which throttle validator exits to maintain network stability. "Price surges always trigger unstaking," observes Andy Cronk of Figment, noting this pattern holds across both retail and institutional participants. The current exodus follows a March-April influx of validators when ETH traded between $1,500-$2,000.

Bitmine Immersion Technologies Soars on ARK Invest's $182M Ethereum Bet

Bitmine Immersion Technologies (BMNR) surged 3.56% to $40.98 after ARK Invest acquired a $182 million stake, signaling strong institutional confidence in the company's pivot to Ethereum. The capital injection will primarily fund ETH treasury acquisitions, with $177 million earmarked for ether purchases.

ARK's block trade execution through BitMine's ATM program triggered a midday recovery following early volatility. Trading volume spiked as markets interpreted the move as a strategic endorsement of Ethereum's institutional adoption trajectory.

The deal positions BitMine to capture 5% of ETH's market share, reflecting growing demand for crypto-native treasury strategies among public companies. Cathie Wood's firm continues doubling down on its blockchain infrastructure thesis through concentrated bets.

Privacy Emerges as Core Focus for Ethereum's Next Evolution

Ethereum approaches its 10-year anniversary on July 30 having revolutionized finance through smart contracts, DeFi, and NFTs. The network now stands at an inflection point where institutional adoption demands new privacy safeguards.

While past upgrades like The Merge improved efficiency, the next phase must address radical transparency flaws. Public ledgers currently expose financial details akin to "revealing your net worth when buying coffee"—a design antithetical to traditional finance norms.

The ecosystem's maturation brings banks, governments, and mainstream users who require confidentiality. Without privacy-preserving features, Ethereum risks compromising the cypherpunk ideals of financial freedom that originally inspired its creation.

SharpLink's Ether Holdings Surge Past $1.3B Amid Aggressive Accumulation Strategy

SharpLink Gaming (SBET) has escalated its Ethereum treasury strategy with a record weekly purchase of 79,949 ETH, pushing its total holdings to 360,807 ETH worth $1.33 billion. The acquisition, executed at an average price of $3,238, underscores the firm's bullish stance despite ETH's 2.4% dip over 24 hours. SBET shares rose 6% in premarket trading following the announcement.

The company, chaired by Ethereum co-founder Joseph Lubin, retains $96.6 million from share sales for further ETH buys. Its pivot to a crypto treasury model mirrors MicroStrategy's Bitcoin playbook, now adapted for Ethereum's ecosystem. SharpLink operates validators and stakes ETH, capitalizing on network rewards while positioning as a top corporate holder of the asset.

Lubin hailed the GENIUS Act's passage as a regulatory milestone for blockchain. The firm recently expanded its ATM facility to $6 billion to fund additional ETH acquisitions, signaling unwavering institutional confidence in Ethereum's long-term value proposition.

SharpLink Gaming Acquires 79,949 Ethereum in Largest Weekly Crypto Purchase

SharpLink Gaming, Inc. has dramatically expanded its Ethereum reserves, reporting a 29% week-over-week surge in holdings. The U.S.-listed company now holds 360,807 ETH as of July 20, adding 79,949 tokens at an average cost of $3,238 each—its largest single-week acquisition since launching its crypto treasury initiative.

The firm's digital treasury strategy, unveiled in June 2025, has positioned it as the world's largest corporate holder of Ethereum. Beyond purchases, SharpLink has earned 567 ETH through staking rewards, demonstrating active participation in Ethereum's proof-of-stake network.

A newly introduced 'ETH Concentration' metric tracks shareholder value in real terms, showing a 53% increase to 3.06 ETH per 1,000 diluted shares since the program began. The growth reflects a deliberate strategy to optimize treasury performance through blockchain assets.

Ethereum Boosts Its Gas Limit to Enhance Network Efficiency

Ethereum's network has undergone a significant upgrade with its gas limit increased by 25% to 45 million units, up from 36 million. The adjustment, implemented in block 22,968,004, received approval from nearly half of the network's validators. This change enhances transaction capacity by allowing more computational power per block, directly improving scalability.

The gas limit adjustment process requires no hard fork—validators simply propose new block configurations. Once support exceeds 50%, the limit automatically updates. Previous increases saw the limit double from 15 million in 2021 to 30 million, then rise to 36 million in February. Discussions are already underway for further hikes to 60 million short-term and 150 million long-term, potentially enabled by the upcoming Fusaka hard fork (EIP-7935).

Growing demand for Ethereum's block space drives these changes. The network continues evolving to meet scalability needs while maintaining security—a balancing act critical for its long-term viability as a decentralized platform.

Ethereum Price Prediction – $4,096 Breakout or Pullback to $3,525?

Ethereum's price rally has surged 22% in a week, peaking near $3,856 before a 4.18% dip sparked short-term uncertainty. Regulatory jitters and ETF outflows linger, but onchain data suggests this is a healthy cooldown, not a reversal. The $2,520 cost-basis cohort is taking partial profits, yet nearly 2 million ETH remains unmoved—a sign of enduring bullish conviction.

Glassnode's heatmap reveals strategic rebalancing: holders trim positions but maintain core exposure, while new buyers absorb sell pressure. ETH trades at $3,635 with RSI retreating from overbought territory to 51, signaling tempered momentum. The battle between profit-taking and accumulation sets the stage for either a $4,096 breakout or a retreat to $3,525 support.

Ethereum Mirrors Historic Bull Run Pattern as Institutional Demand Surges

Ethereum's 51% July rally to $3,800 has drawn comparisons to the Dow Jones' 1980 bull market structure, with analysts identifying a textbook expanding diagonal formation. The pattern, which previously preceded a 245% ETH surge between 2022-2024, suggests a potential final wave targeting $8,000 according to Elliott Wave principles.

Institutional activity has intensified with $1.18 billion worth of ETH withdrawn from exchanges this month. ETF inflows reached $5.5 billion total, including nearly $1 billion in the past week alone. The ascending triangle formation now faces a critical test at the $4,000 resistance level.

Market structure echoes the final stages of historic bull markets, where broadening patterns typically precede explosive moves. Current derivatives activity and spot market demand indicate growing Wall Street participation in what may be Ethereum's last major rally of this cycle.

Tornado Cash Co-Founder's Legal Team Considers Mistrial Motion Over Disputed Testimony

Roman Storm's defense attorneys are preparing a potential mistrial motion following contested testimony from a government witness in the Tornado Cash case. The witness, Hanfeng Lin, claimed $190,000 in crypto losses through Tornado Cash, but blockchain analysis by experts Taylor Monahan and ZachXBT contradicts this assertion.

Prosecution's case shows cracks as FBI crypto specialist Joseph DeCapua admitted he wasn't directed to examine Lin's specific transactions. The defense argues the testimony lacks relevance to Storm's platform, creating what they view as prosecutorial overreach in a case carrying 45-year maximum penalties.

Market observers note the proceedings could set important precedents for privacy tool development in crypto. The outcome may influence how regulators approach mixing services and their creators, with implications for Ethereum-based privacy solutions.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

| Year | Conservative | Base Case | Bull Case | Catalysts |

|---|---|---|---|---|

| 2025 | $3,525 | $4,096 | $4,800 | ETF approvals, gas limit upgrades |

| 2030 | $8,000 | $12,500 | $18,000 | Enterprise adoption, scaling solutions |

| 2035 | $15,000 | $25,000 | $40,000 | Full tokenization of real-world assets |

| 2040 | $30,000 | $50,000 | $75,000+ | Global settlement layer status |

"Ethereum mirrors its 2021 bull run but with stronger fundamentals," says BTCC's Emma. "The 2025 prediction hinges on breaking $4,096 resistance, while long-term targets assume successful implementation of Proto-Danksharding and sustained institutional inflows at current rates."